The Future of Carbon Credits: Why the Carbon Market Is Set to Surge by 2030

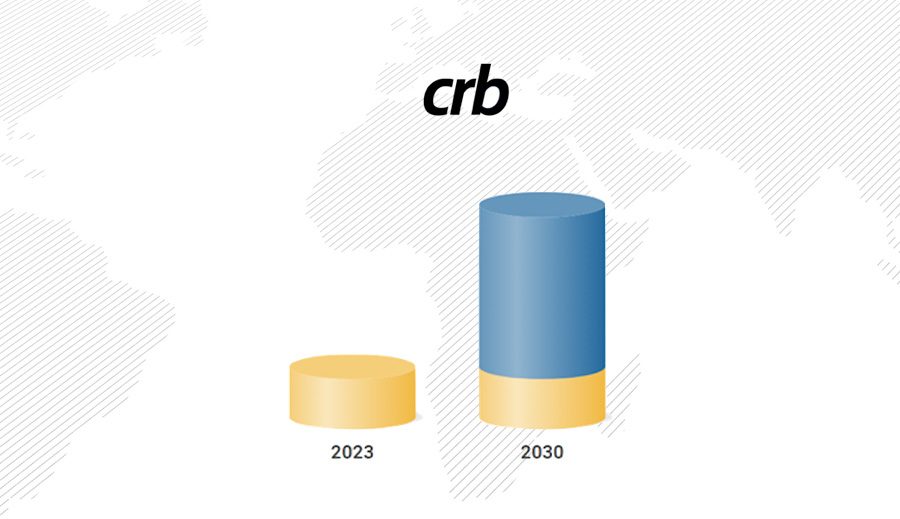

The global carbon credit market is expanding fast. According to recent projections, its value rose to roughly $1.4B in 2024 and is expected to reach $7–35B by 2030, with the potential to hit $45–250B by 2050. For consumers, SMEs, and investors using crbcoin (CRB), this growth signals a powerful shift in how carbon offsets will be bought, priced, and used over the coming years.

What Is a Carbon Credit?

A carbon credit represents one metric ton of CO₂ that has been avoided or removed from the atmosphere. Examples include:

- Mangrove restoration that captures and stores carbon in trees and coastal soils

- Cookstove projects that reduce firewood use and emissions while improving household health

- Borehole and water purifier programs that cut diesel use and deforestation

Companies, governments, and individuals buy these credits to offset emissions they cannot fully eliminate.

Why the Carbon Market Is Growing

Two forces drive the surge in the voluntary carbon market (VCM):

- Rising demand — Net-zero targets, tighter climate rules (especially in the EU), airline obligations under CORSIA, and growing consumer participation all increase the number of buyers.

- Higher prices per credit — As low-quality credits are filtered out by initiatives like ICVCM and stricter registry rules, buyers favor high-integrity carbon credits with strong monitoring and verified impact, which cost more to produce.

What the Growth Really Means (Demand, Supply, Value)

Put simply:

- More demand → more credits are purchased by businesses, airlines, SMEs, and consumers.

- Better (scarcer) supply → the market shifts toward quality projects; weaker projects fade out.

- Higher value → average prices move from low single digits to $20–$50/ton (and higher for top-tier projects) by 2030.

This combination of volume growth and price uplift explains the jump from $1.4B to potentially tens of billions by 2030.

Simple Example

If in 2024 the market sold 200M credits at $7 each (~$1.4B), then by 2030 it could sell 700M credits at $30 each (~$21B). The exact numbers will vary, but the logic is clear: rising demand + higher average prices = rapid market expansion.

Where crbcoin (CRB) Fits In

Crbcoin aims to be the go-to hub for consumers and SMEs entering the carbon market. While governments and large corporates invest billions, everyday participants also need a simple, transparent route to support climate projects and access the value of carbon credits. CRB connects people to high-impact projects and brings clarity to the carbon offsets journey.

Why High-Quality Projects Matter

Projects with measurable, durable impact will command premium pricing and long-term trust:

- Mangroves — carbon sequestration + coastal protection + biodiversity gains

- Cookstoves — emissions reduction + health benefits + reduced deforestation

- Water purifiers & boreholes — less fuel use, better water security, community benefits

As standards tighten, these projects are likely to set the benchmark for quality in the voluntary carbon market.

Lessons from Early Adoption

Think of Bitcoin in 2012: few believed; a decade later, outcomes surprised even early adopters. The carbon market shares similar traits—clear demand growth, constrained high-quality supply, and long-term necessity. With CRB, users can engage early, support credible climate action, and participate in a market positioned for structural growth.

2030 Outlook

What to expect by 2030:

- More participants (corporates, airlines, SMEs, consumers) buying carbon credits

- Higher average prices for verified, high-integrity carbon offsets

- Greater transparency from standards and registries, improving trust in the market

Together, these trends underpin the forecasted rise to $7–$35B by 2030 and potentially far higher by 2050.

Bottom Line

The future of the carbon credit market is driven by surging demand and a shift toward high-quality supply—pushing overall market value and average prices higher. With crbcoin (CRB), individuals and SMEs get an accessible path into this growing space, combining climate impact with a transparent, community-driven approach to carbon credits.