Overview

CRB Price: $0.02276

0.71% (24h)

6m Change:

112.66%

Market Cap: $22.76M

Transfers: 983

Blockchains: 6

24/7 Live From One of Our Carbon Credit Projects in Senegal.

AI-Selected Projects

C02 removed: 315,000 tonnes

Leverage momentum toward net-zero by tapping the $80 billion carbon market.

The carbon market, backed by 196 governments and the European Union, is the world's fastest-growing market, offering significant and secure investment opportunities.

The road to net zero

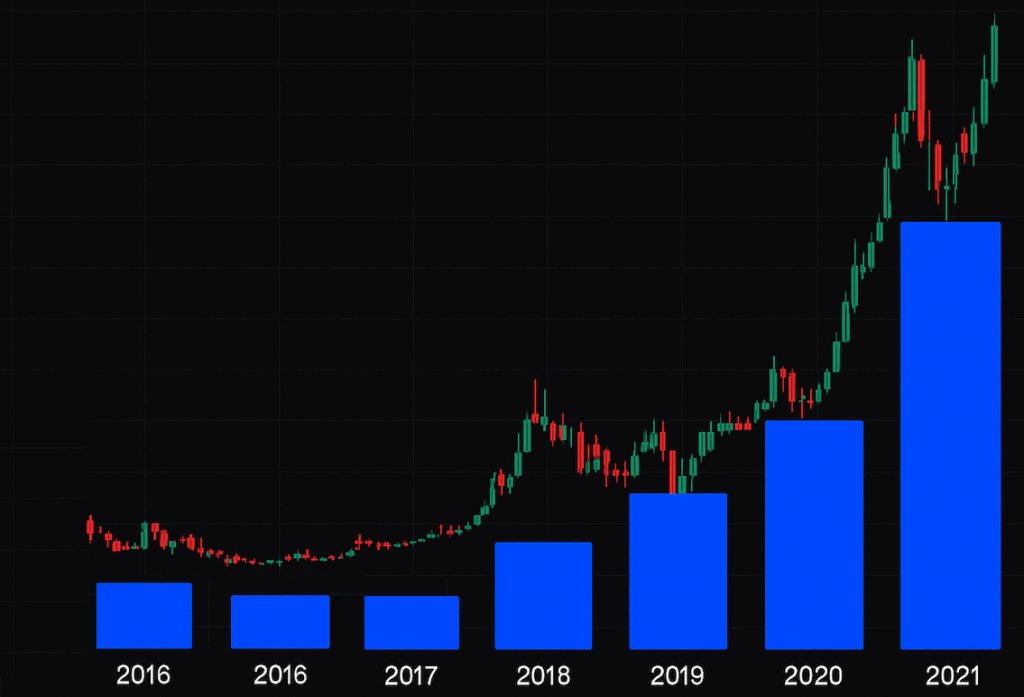

In 2015, 196 nations adopted the Paris Agreement to limit warming to 1.5°C, supported by a regulated carbon market with registry-verified credits.

Expected to be valued at 1.2 trillion by 2050.

McKinsey highlights the carbon removal market's value at $80 billion by 2030, projected to soar to $1.2 trillion by 2050.

Crbcoin is accessible on multiple blockchains: ETH, BSC, POLYGON, AVALANCHE

Carbon x Crypto x AI – Three booming markets. One powerful asset.

Crbcoin (CRB) is the first crypto backed by real-world carbon credits and enhanced by AI. Powered by verified carbon projects, delivering real value with measurable impact.

With carbon markets booming, AI transforming decision-making, and crypto reshaping finance, Crbcoin unites three of the world’s fastest-growing sectors into one high-potential crypto asset.

Celebrities and CEOs about Carbon Credits.

Discover the perspectives of major corporations and celebrities on Carbon Credits.

Explore the latest articles

Discover the newest trends and tips from the world of environmental ecosystems and cryptocurrency.

Learn more

A Carbon Credit represents a unit of measurement for one ton of carbon dioxide (CO2) emissions that has been either prevented or removed from the atmosphere through a certified carbon reduction project.

The Carbon market is experiencing significant growth, with the global carbon trading volume reaching new heights. With 196 countries participating in the Paris Agreement and increasing commitments to carbon neutrality, the market is expected to expand further. Analysts anticipate substantial growth in the carbon market, with projections estimating its value to reach trillions of dollars in the coming decades.

Yes, the funds raised by Crbcoin are allocated to projects aimed at generating carbon credits for the voluntary market, compliance market, and ITMOs (Internationally Transferred Mitigation Outcomes

Hilde Watty is the CEO and Founder of Crbcoin and one of Belgium’s most successful female entrepreneurs. She became well-known through her exclusive matchmaking company for high-net-worth individuals and is also an author with decades of business experience.

She does not take a salary from the company and has invested heavily with her own capital, fully aligning her interests with investors and partners. Hilde Watty led the decision to implement AI across the entire organisation, from project selection to monitoring and verification. Through her hands-on leadership and technology-driven approach, she connects sustainability, innovation, and measurable global impact at Crbcoin.