The big 4 about the carbon market.

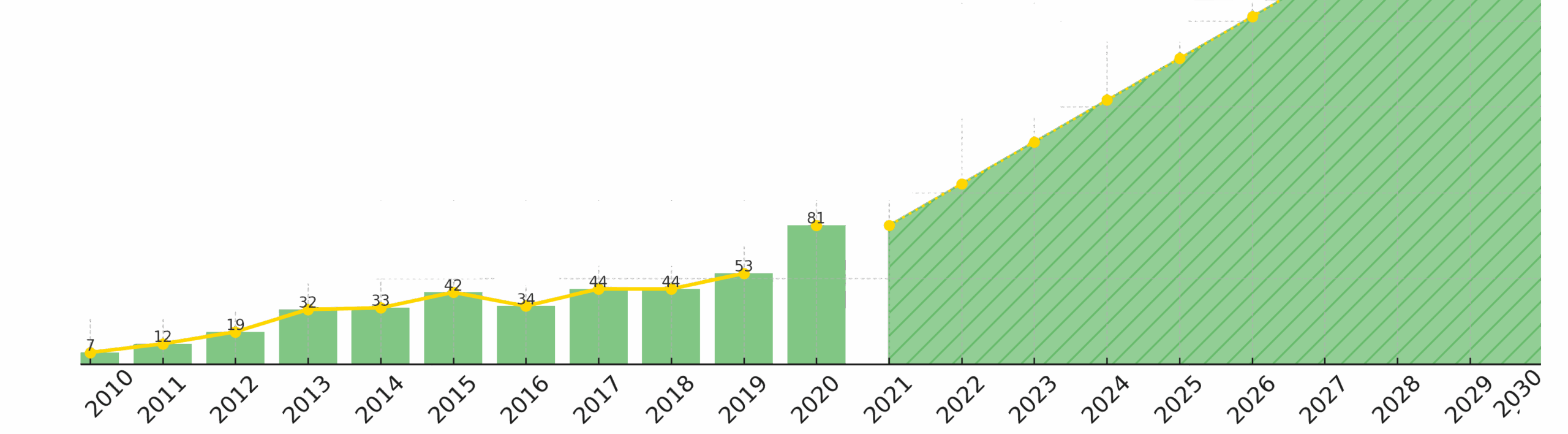

Leading consultancies such as Deloitte, PwC, EY, and KPMG identify the carbon credit market as a fast-growing sector, driven by net-zero goals. Their reports emphasize the potential of digital credits like Crbcoin to boost transparency, accessibility, and liquidity, while aligning with climate targets and ESG trends.

KPMG

“Rapidly growing and essential, forming a cornerstone for achieving global net-zero commitments.”

PwC

“An emerging trillion-dollar market, unlocking high value while advancing climate goals globally.”

Deloitte

“Scalable and impactful, driving corporate ESG strategies and sustainable investments.”

EY

“Transparent and future-proof, aligning financial markets with decarbonization objectives.”

The Big Four

The Big Four—Deloitte, PwC, EY, and KPMG—are the world’s leading audit and consulting firms. Their research shapes how governments, institutions, and investors approach the carbon credit market and the broader ESG (Environmental, Social, and Governance) investment landscape. By following their guidance, investors gain trusted, data-driven insights into the opportunities and risks in the rapidly growing carbon credit sector.

The Big Four influence the global carbon market outlook by publishing in-depth reports on climate finance, carbon credit market trends, and net-zero strategies. Their analysis is used by policymakers, corporations, and institutional investors to understand where the carbon credit market is heading, what regulatory changes are coming, and how digital carbon assets like Crbcoin can align with global decarbonization goals.

Deloitte, PwC, EY, and KPMG have identified strong growth trends in the carbon credit market, driven by rising demand for carbon offsets, corporate sustainability goals, and global net-zero commitments. They highlight that the voluntary carbon market could become a trillion-dollar sector, with digital carbon credits increasing transparency and liquidity, making it easier for investors to participate in climate-positive investments.

Investing in carbon credits and digital assets like Crbcoin carries financial risk. By following the Big Four’s market insights, investors can reduce risks by aligning with best practices, staying informed on regulatory developments, and understanding pricing trends and liquidity factors within the carbon credit market. Their guidance helps investors build resilient climate investment portfolios that support long-term returns while contributing to sustainability.

Yes, the Big Four consistently highlight carbon credits as a high-potential investment opportunity aligned with ESG and climate goals. They project that demand for high-quality, verifiable carbon credits will increase significantly as more companies and countries adopt net-zero targets. This makes the carbon credit market—and digital carbon credits like Crbcoin—a strategic asset class for investors seeking to generate returns while supporting global climate action.