Bullish growth projections in the carbon market

The average carbon price is expected to average around $42 per metric ton in 2025 and $46 per ton in 2026, according to BloombergNEF.

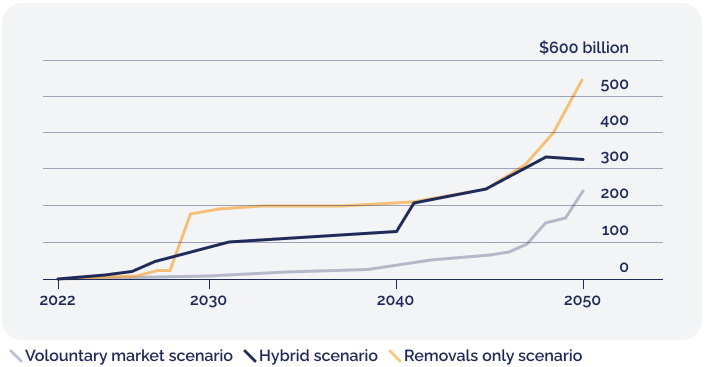

Bloomberg projects the market to hit $500B by 2050.

Just a few companies that purchased offsets in January '25 alone.

McKinsey foresees robust expansion in the carbon market until 2050, fueled by heightened climate awareness, regulatory mandates, and consumer preferences. Demand for carbon offsets is expected to surge as companies strive for carbon neutrality, supported by advancing technologies and global carbon pricing mechanisms.

PwC anticipates significant growth in the carbon market until 2050, driven by escalating climate concerns, stringent emission regulations, and corporate sustainability goals. Increased investment in renewable energy and carbon offsetting initiatives are expected to propel market expansion.

KPMG anticipates substantial growth in the carbon market until 2050 due to escalating environmental regulations and corporate sustainability commitments. Increased investment in renewable energy, carbon offset projects, and carbon pricing mechanisms are expected drivers of this growth.